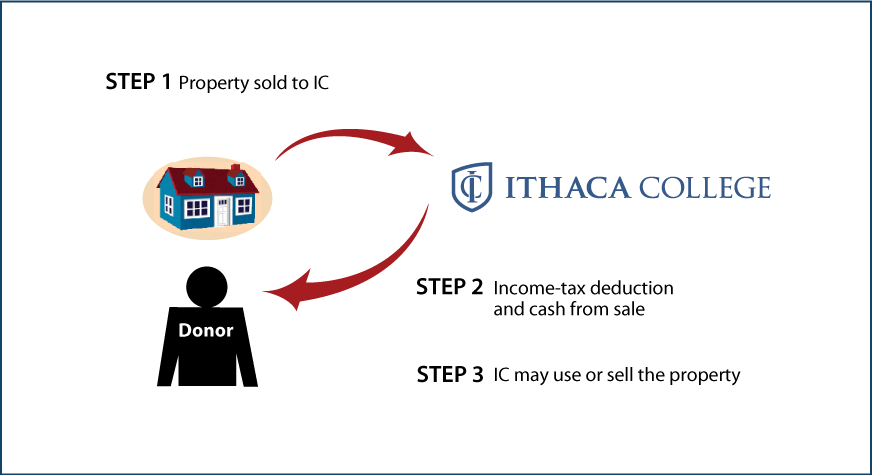

Real Estate—Bargain Sale

How It Works

- You sell property to IC for less than its fair-market value—usually what you paid for it

- IC pays you cash for agreed sale price, and you receive an income-tax deduction

- IC may use or sell the property

Benefits

- You receive cash from sale of property (sale price is often the original cost basis)

- You receive a federal income-tax deduction for the difference between the sale price and the fair-market value of the property

- IC receives a valuable piece of property that we may sell or use to further our mission

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

Pamela Sheradin |

Ithaca College |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer